Overview

Easby's Credit Card Expense Management feature is a tool for cardholders and management to efficiently handle credit card expenses and bolster financial control within organizations. One of Easby's key strengths is its advanced transaction coding system. It uses historical transaction data and AI-driven predictive coding to categorize expenses. This system analyzes a cardholder's past interactions with vendors to predict and suggest the most suitable coding.

Easby's machine learning pairs predictive coding with a percentage confidence level, providing real-time accuracy indicators to reduce the need for manual input. By relying on Easby's predictive coding system, users benefit from data-driven categorization. This not only saves time but also significantly improves accuracy, reducing errors in financial reporting. With Easby, companies benefit from a more efficient and confident approach to overseeing expenses. It's a tool that transforms credit card expense management, offering practical precision and reliability.

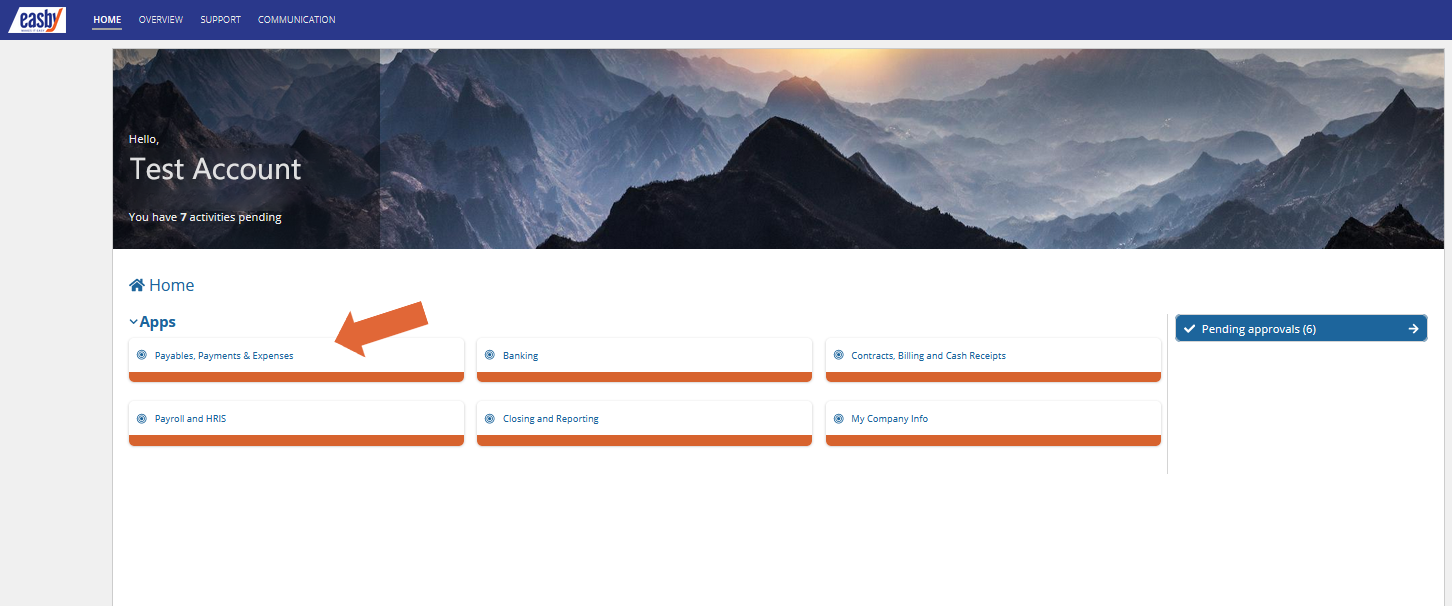

How do I access the Expense Transactions Page?

1. From Easby’s Home Page, click on Payables, Payments & Expenses

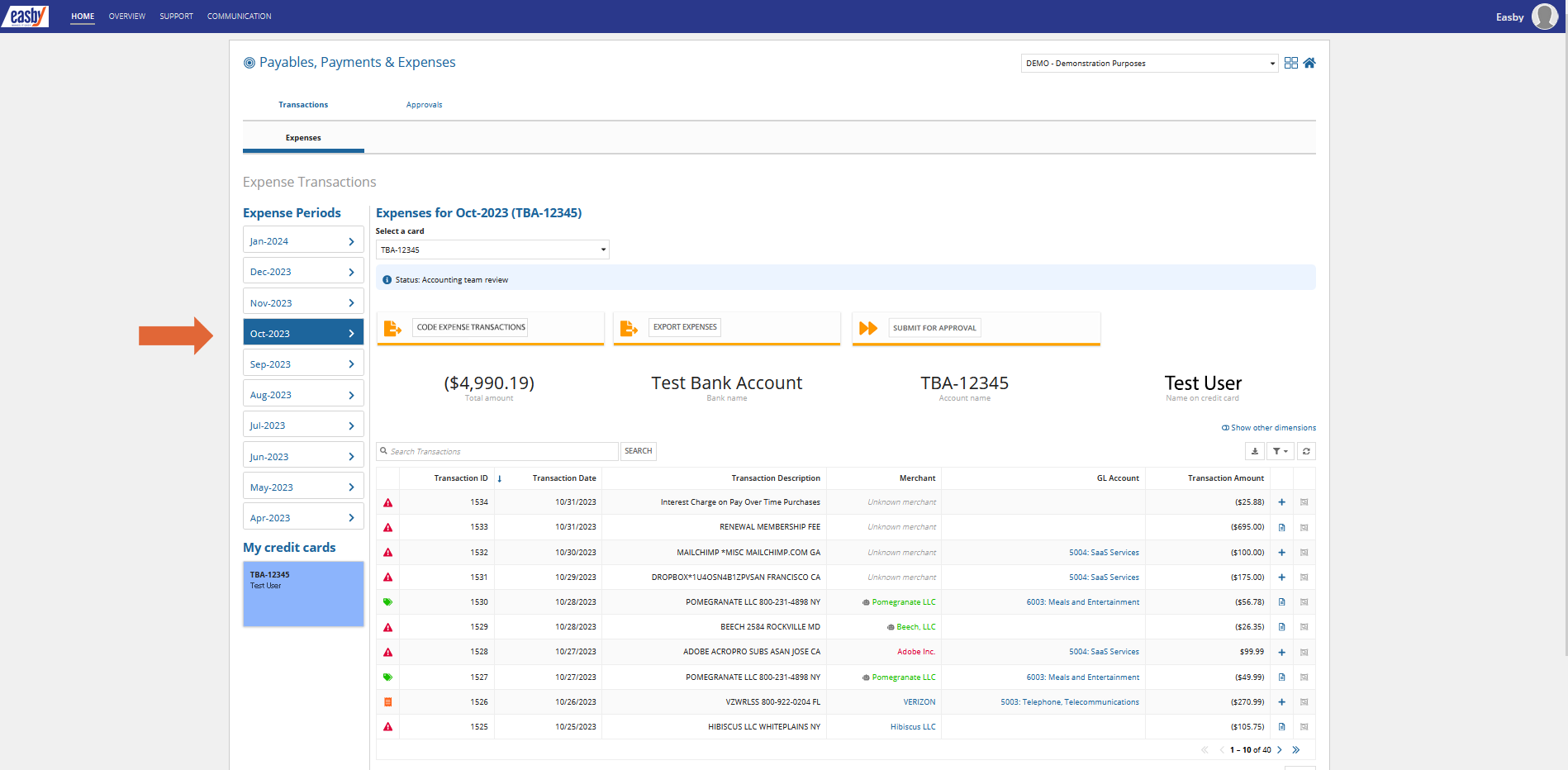

2. You will land on the Payables, Payments & Expenses app.

3. Select the “Transactions” menu

4. Select the “Expenses” sub-menu.

5. Click on a period to view data for a certain time frame.

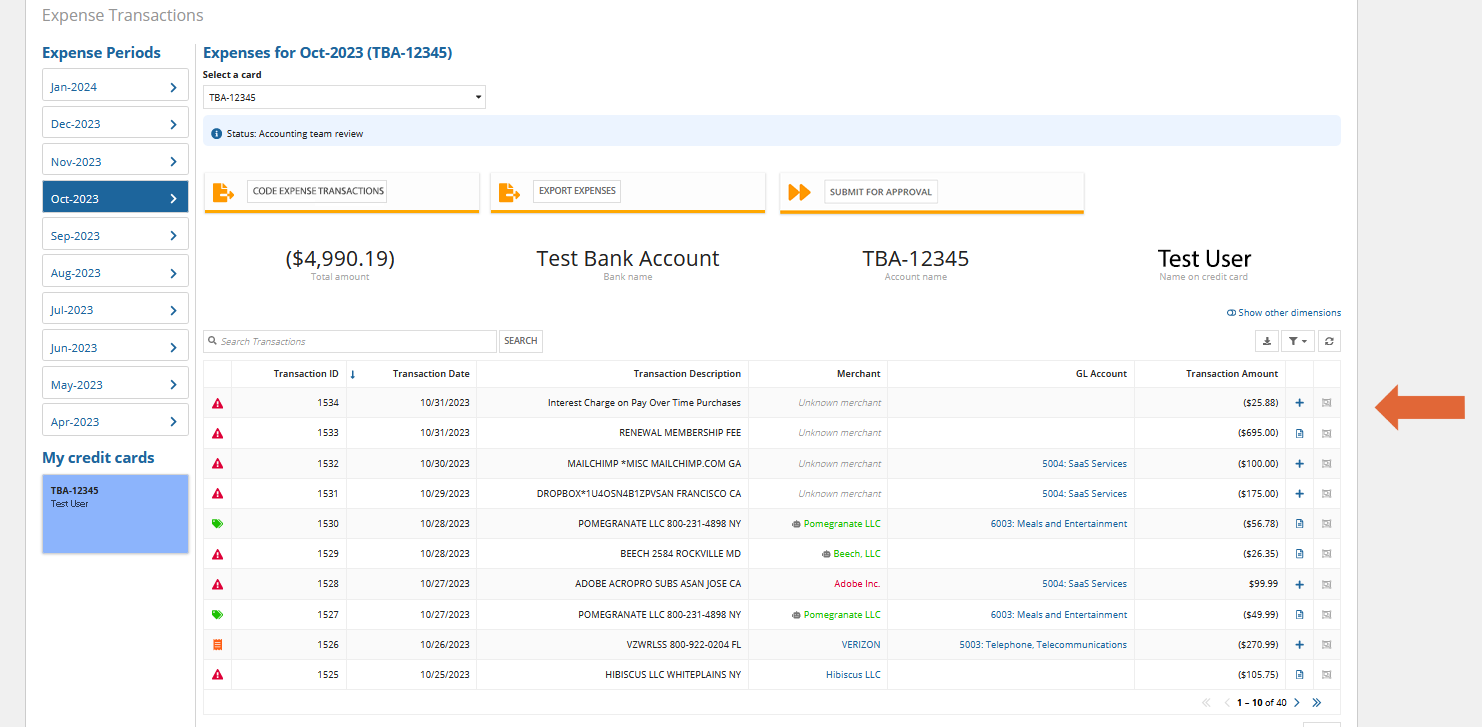

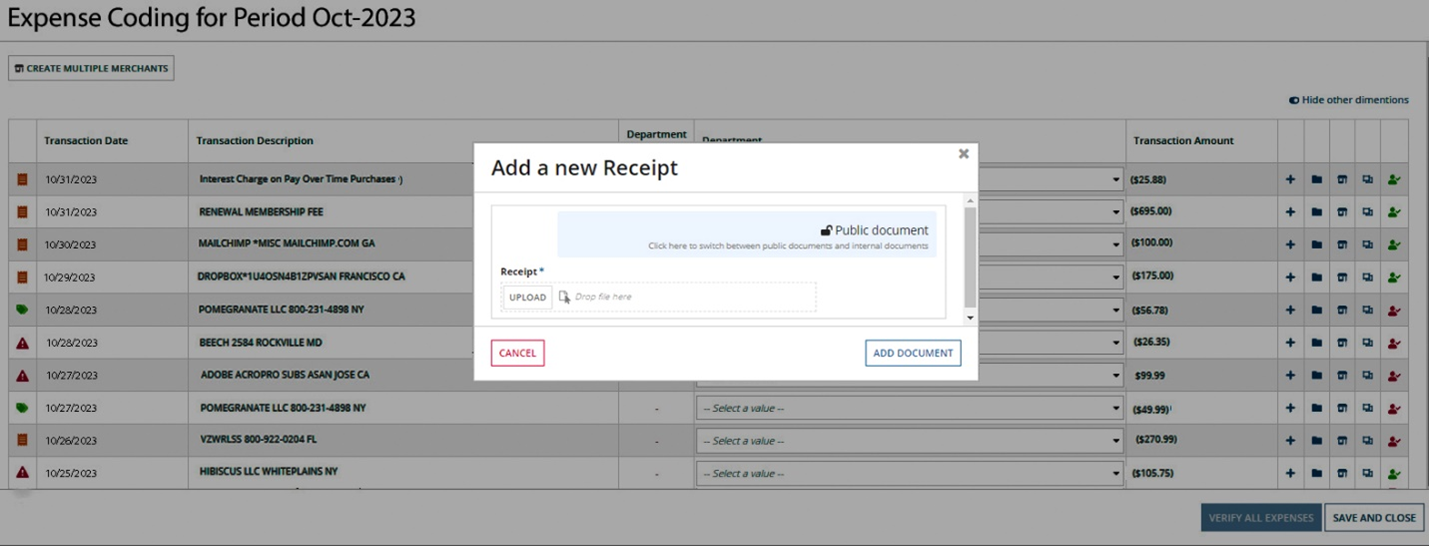

6. Users have the ability to add receipts or supporting documentation to each transaction.

7. In order to add a new receipt or supporting documentation, users must click the “+” icon on the far right of each transaction.

8. Press add document to complete the update.

What do the various symbols to the left of each transaction indicate?

Each transaction includes symbols to the left of each line. Users benefit from interactive symbols in the module, enabling them to quickly identify areas that require attention. The symbols are as follows:

Data Missing (GL Missing) or Data Predicted with Low Confidence

Data Not Verified

Receipt Missing

Completed and Verified

What are GL Codes and why are they important?

GL Codes dictate the precise allocation of expenses within the Chart of Accounts, significantly influencing accurate financial reporting and efficient budget management. Utilizing these dimensions not only facilitates in-depth reporting and analysis but also empowers users to make informed decisions based on spending patterns and budget optimization strategies.

Where Do I Review and Update My GL Code Information?

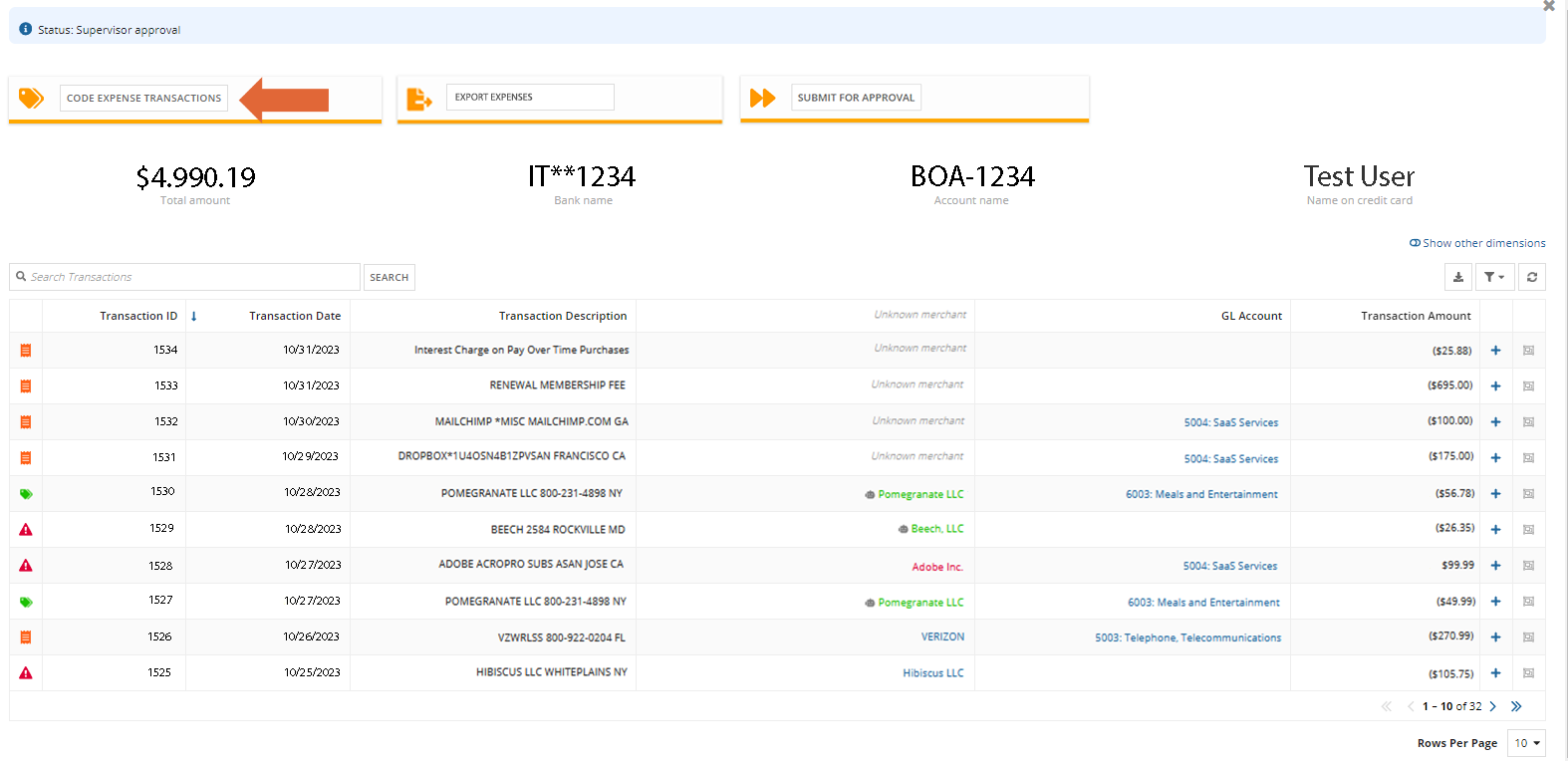

1. To review and update GL Code information, click the “Code Expense Transactions” button on the top left of your screen in the monthly expenses view.

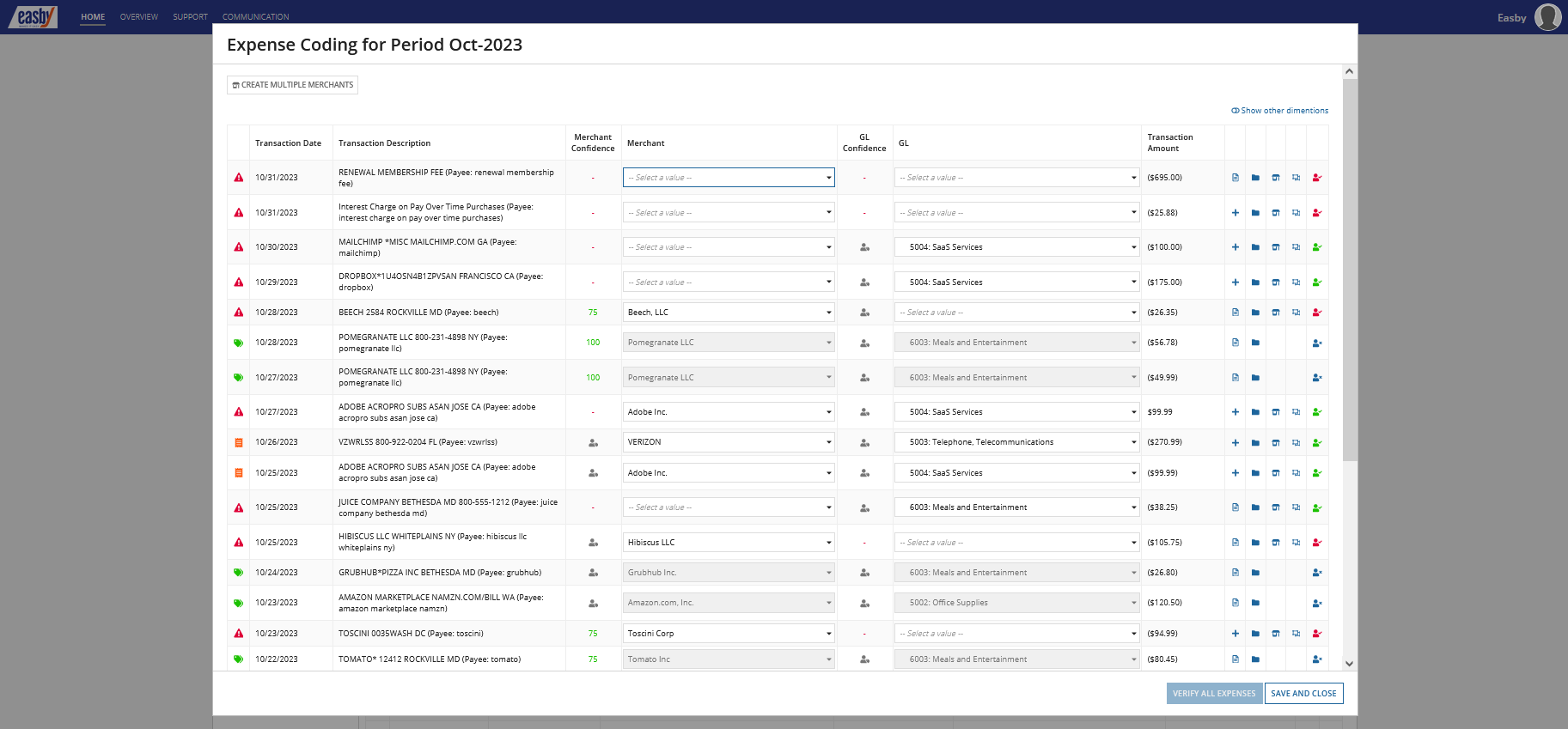

2. Users then can select a merchant and GL Code. Easby will attempt to populate these areas with predicted data. However, users can review and correct these areas, benefited by Easby’s confidence indicators.

3. Click “Save and Close” to save your progress and come back to the activity at a later time.

4. Users have the ability to verify expenses as they work through the activity. To verify all expenses, click the blue button at the bottom right of your screen. Clicking the “Verify All Expenses” button indicates all expenses have been verified.

What if my company is using department or class coding?

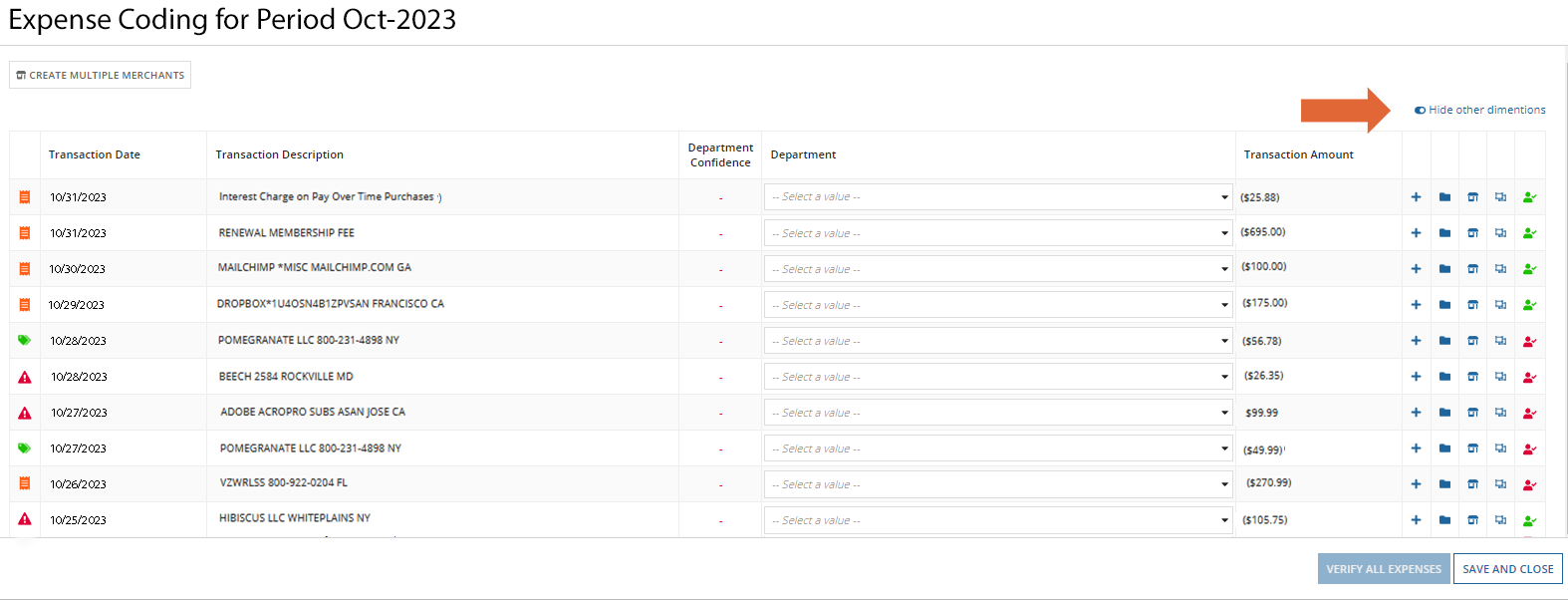

If your firm is using departmental or class coding, click the “Show other dimensions" button to go to the departmental view. Click “Hide other dimensions” to return to the default view.

How Often Will I Receive Transaction Notifications?

ROSE understands the importance of timing in credit card expense management. That's why Easby is designed as an intuitive system that allows supervisors and managers adequate time to review and approve expenses.

Starting on the 5th of every month, Easby will send email reminders to users for completing GL coding for the previous month. These reminders will persist until the associated activity is submitted. Users are allowed to submit receipts for the previous month until the submission of the activity. Client approvers and managers with also receive notifications when a coder has submitted an activity. Submission of activities is contingent upon the completion of GL coding for all transactions.